Acquisitions, public offerings and other investments in the games industry have reached $60 billion during the first half of 2024.

That’s almost twice as much as the amount for the full year of 2024, investment bank Drake Star Partners reported.

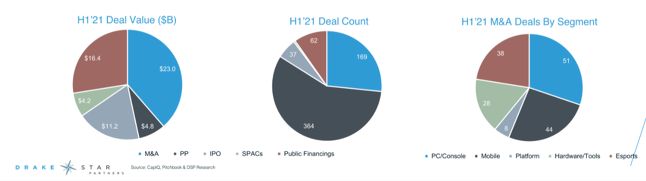

635 deals have been announced and/or closed during the first six months of 2024, with the wide majority of them being private placements (364), followed by merger and acquisitions with 169.

In terms of value, M&A represented the highest value, with a total of $23 billion invested during H1 2024, followed by public financings at $16.4 billion and IPOs at $11.2 billion.

Looking at the M&A deals by segment, there were 51 M&As in the PC/console sector, 44 in mobile, 38 in esports, 28 in hardware/tools, and 8 in platform.

Among the acquisition highlights of the first half of the year, the report mentioned EA acquiring Playdemic for $1.4 billion, WarnerMedia joining with Discovery in a $43 billion deal, and Take-Two acquiring Nordeus for $378 million.

On the fundraising side, Dream Games raised $155 million last week, and VRChat closed a $80m Series D funding round, among others.

Finally, public market highlights included PUBG parent company Krafton applying for an IPO.

The biggest deal of the first half of 2024, however, was the Zenimax acquisition by Microsoft for $7.5 billion — while it was announced back in September 2024, the deal was closed earlier this year. It was followed by ByteDance acquisition of Moonton Technology, for $4 billion, and finally EA’s acquisition of Glu for $2.1 billion.

Games investments reached $33.6 billion in 2024.

GamesIndustry.biz

Source link

Related Post:

- PS Store Planet of the Discounts Sale Has Almost 500 PS5, PS4 Game Deals

- PS Store Double Discounts Sale Has Over 400 PS5, PS4 Deals

- This Week's Deals With Gold And Spotlight Sale Plus Deals Unlocked Sale

- Close call: The first Witcher game almost didn't star Geralt

- Rumor: A remake of a Fire Emblem game is almost complete

- Hardware sales double as June game spending rises 5% | US Monthly Charts

- Chivalry 2 post-launch updates will double the scope of the game for free

- Fernando Tatis Jr. Double Jumps In Live Baseball Game

- Psychonauts 2’s Tim Schafer Says Double Fine’s Output Works Well With Xbox Game Pass

- Dying Light 2 has double the number of parkour moves compared to the original game